Overview

Launched in 2022, LPT Realty has achieved explosive growth. It ranked as the 16th largest brokerage by US sales volume, according to the 2025 Mega 1000. The fast-growing, cloud-based brokerage has offices in every state and a budding international presence.

Leveraging the success of its national brokerage brand platform, LPT’s parent company, LPT Holdings, announced in early August its imminent intention to go public on the Nasdaq stock exchange with the ticker LPTA. This article examines the company’s explosion onto the industry scene and the business model fueling the firm’s growth.

Robert Palmer founded Lake Mary, Florida-based LPT Realty with an innovative hybrid brokerage model that combines elements of the fee-based and capped brokerage models. The brokerage grew rapidly by leveraging the emerging power of scale, technology and business model that defines the emerging national brokerage platform trend.

Palmer’s move into residential real estate followed his success founding mortgage company RP Funding in 2008. After becoming a regional leader in home financing, Palmer recognized an opportunity to deploy the marketing strategies — with a heavy focus on print marketing — and technological savvy he’d developed in his mortgage work to launch a brokerage that could scale quickly and attract and support agents.

Four years later the cloud-based brokerage he leads as CEO is the nation’s 16th largest brokerage by sales volume and the 10th largest by sides, according to the 2025 Real Estate Almanac.

LPT Realty operates in all 50 states and had nearly 15,000 agents who did approximately $13.9 billion in sales and over 36,000 in sides in 2024. The firm announced in early August that it has reserved a ticker, “LPTA” on the Nasdaq stock exchange with imminent plans to go public.

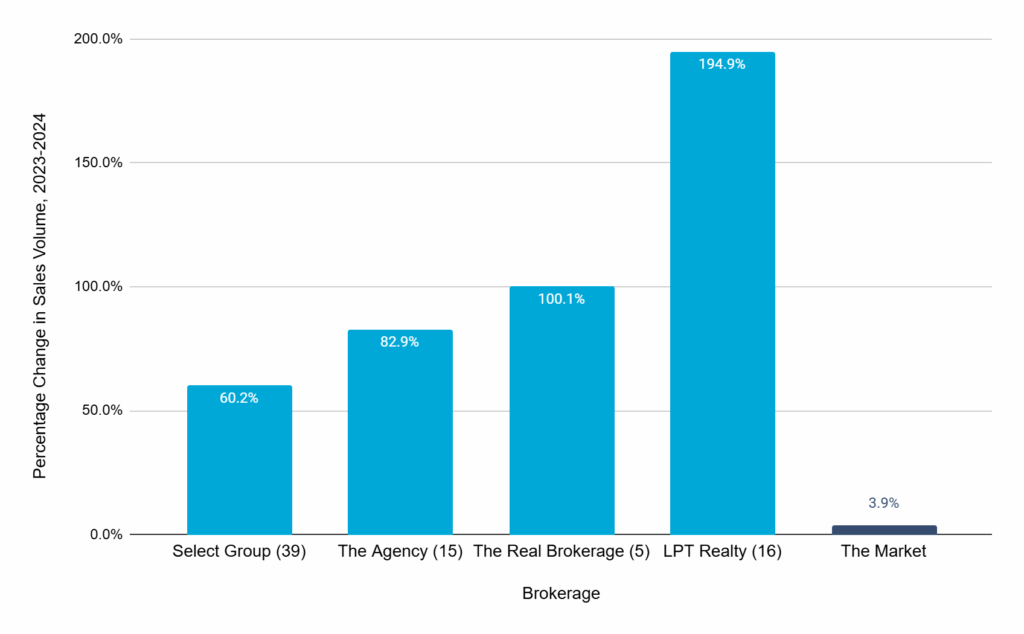

The firm had the biggest sales volume growth of any of the US’s 100 largest brokerages with 194.9% growth in sales volume between 2023 and 2024.

This was nearly double the growth of the brokerage with the next-largest leap, The Real Brokerage, and 50X the overall market, as determined by NAR existing home sales data.

Brokerages (among Top 100) with Largest Change in Sales Volume, 2023-2024

Source: T3 Sixty

This article examines the national brokerage platform trend, which will be explored more fully in the upcoming 2026 edition of the Swanepoel Trends Report, due out this fall.

The National Brokerage Platform

LPT Realty has no brick-and-mortar offices and offers revenue-sharing and fee-based compensation options to agents, two important elements of the national brokerage platform model.

A brokerage leveraging this trend tends to have a strong, tech-focused centralized technology platform and services with no brick-and-mortar offices and relatively low employee head count.

These brokerages generally offer agents an attractive mix of compensation on top of the traditional commission split, such as revenue sharing in which they share with agents the revenues generated by agents those agents recruit and granting equity in the company based on certain actions agents take that benefit the company.

LPT Realty’s phenomenal growth has been fueled, in large part, by an innovative business model in which it provides flexible compensation plans to agents while leveraging the powerful benefits of a national brokerage platform.

Other brokerages leveraging a national brokerage platform strategy to achieve spectacular growth include eXp Realty and The Real Brokerage, the US’s third and fifth largest brokerages, respectively, which deploy similar business model elements.

Large Brokerages Deploying a National Brokerage Platform Strategy

| Brokerage | Year Founded (2025 Mega 1000 Rank) | 2024 Sales Volume | 2023-2024 Sales Volume % Change |

| eXp Realty | 2009 (3) | $152.7B | 6.3% |

| The Real Brokerage | 2014 (5) | $42.4B | 100.1% |

| LPT Realty | 2021 (16) | $13.9B | 194.9% |

Source: T3 Sixty

This approach allows the brokerage to scale incredibly quickly with little marginal cost and an incentivized agent recruiting class.

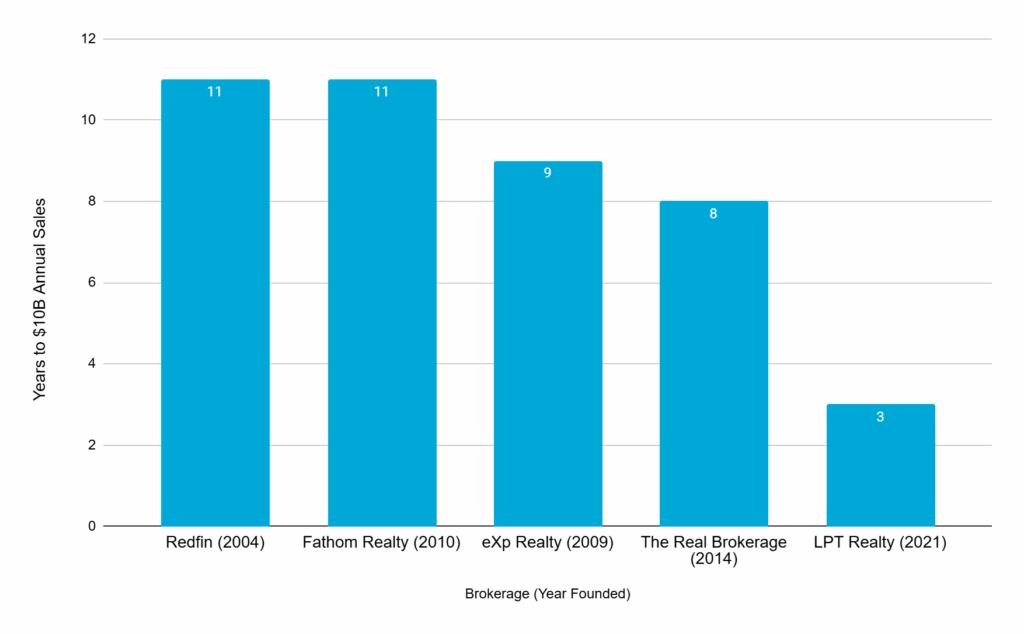

The speed to immense production characterizes this model, and it has accelerated in recent years. It took LPT Realty just three years to achieve $10 billion in annual sales volume ($10 billion puts a brokerage in the top 20 largest in the US). The other firms also achieved this remarkably quickly, but LPT has accelerated this to a blazing fast level.

Years to Reach $10B Annual Sales vs Brokerage

Inside LPT Realty’s Growth

LPT Realty agents can choose from a fee-based or capped model. Both compensation plans come with an annual fee of $500 and a $195 per-transaction fee, and agents can earn stock through both.

In the fee-based model, agents pay $500 per transaction with an annual cap of $5,000, but they cannot participate in revenue share or lead a team. The fee-based option gives agents flexibility and helps teams retain agents who may go through slower production seasons. Agents can switch to the capped plan at any point, but must wait 12 months to switch down to the fee-based plan.

In the capped model, agents earn an 80% split on each transaction with an annual cap of $15,000. Agents on this plan earn a share of the revenue the agents they recruit do, down seven levels. The firm reserves half of its transaction revenue for the revenue-sharing plan.

To incentivize agents to remain in production versus focusing on recruiting, the money they earn through revenue sharing first goes toward their annual cap. Once the cap is reached, the funds go to them as compensation.

Agents on either compensation plan can earn LPT stock. Stock awards, whether for production or referrals, have a three-year vesting period. Agents on the capped plan can also opt out of revenue share in favor of equity grants.

Brokerage and Large Team Fold-Ins

A facet of national brokerage platforms that allows them to grow is the ability to ingest large brokerages and teams onto their platform with a different type of acquisition than cash.

Because of their revenue-sharing and equity tools, they can offer these as direct monetary benefits to brokerages and teams. Owners can come into LPT with large, producing revenue-share downlines and can quickly open up notable equity grants.

In December 2024, Big Block Realty, which ranked as the nation’s 122nd largest brokerage in 2024, brought its nearly 1,200 agents and approximately $2.1 billion in sales volume over to LPT and began doing business as Big Block Realty LPT.

Just a few months later, Minneapolis-based brokerage Realty Group, the nation’s 217th largest brokerage in 2025, brought 750 agents and $1.4 billion in sales volume to LPT. The leaders cited the ability for them and their agents to earn equity from a brokerage approaching an IPO as a key factor in the decision.

The firm has also brought over dozens of large teams in the same way.

New Avenues

LPT Holdings, the firm’s parent company, expanded Palmer’s vision further into the luxury market with the launch of a sibling brokerage, Aperture Global Real Estate, in May 2025.

Launched in 15 states and four international cities — including key markets such as Miami, London, New York, Toronto, and Lisbon — Aperture will operate as a brokerage distinct from LPT Realty. Its agent compensation model follows more of the traditional model and does not include a cap and will feature brokerage-first branding.

The luxury focus for the brokerage will join other luxury brokerages with international brands, but many others typically franchise overseas while LPT Holdings is pursuing a company-owned model.

Takeaway

Launched within the last five years, LPT Realty has leapfrogged thousands of other brokerages to reach the top tier of brokerages in the US. By leveraging the advantages of scale and cost efficiencies of the national brokerage brand platform in addition to a hybrid agent compensation plan offering, the firm has become one of the fastest-growing brokerages in the industry’s history.

With a public stock offering in the offing, aggressive national and international agent growth planned for LPT Realty and a new, separate luxury brokerage, LPT Holdings remains an industry player to watch as it evolves from newcomer into industry power player.

Update: this article has been updated to note LPT Realty launched operations in 2022, not 2021 as an earlier version of this piece stated. The firm incorporated in 2021 but hired its first agents and started doing business in February 2022.