Overview

As severe climate events hit more areas of the country, the calculus of purchasing and owning a home is changing for many Americans, whether many of them directly realize it yet or not.

These events are having a direct impact on the cost and availability of homeowners insurance, which, in turn, has longer-term implications for real estate consumers and brokerages. This article explores the relationship between climate and rising home insurance rates and availability, what it could mean for the future of US real estate and how it affects residential real estate brokerage.

In the first week of July 2025, the Madre fire burning over 50,000 acres in California surpassed January’s devastating fires in Los Angeles to become the state’s largest fire of the year. While in Central Texas, flash flooding from heavy rain killed more than 100 – the deadliest flash flood in the US in half a century – and wrought damage across six counties.

Severe weather events like these are growing in frequency and intensity across the country.

In 2024, the nation saw 27 confirmed weather- or climate-related disaster events with losses exceeding $1 billion each, according to the National Centers for Environmental Information (NCEI). That is twice the annual average of similar disasters (inflation-adjusted) for the previous 40 years.

This increase means more homebuyers and homeowners must contend with risks and costs related to climate events, a significant portion of which includes increases to standard homeowners’ insurance premiums (covering perils such as fire, lightning or hail).

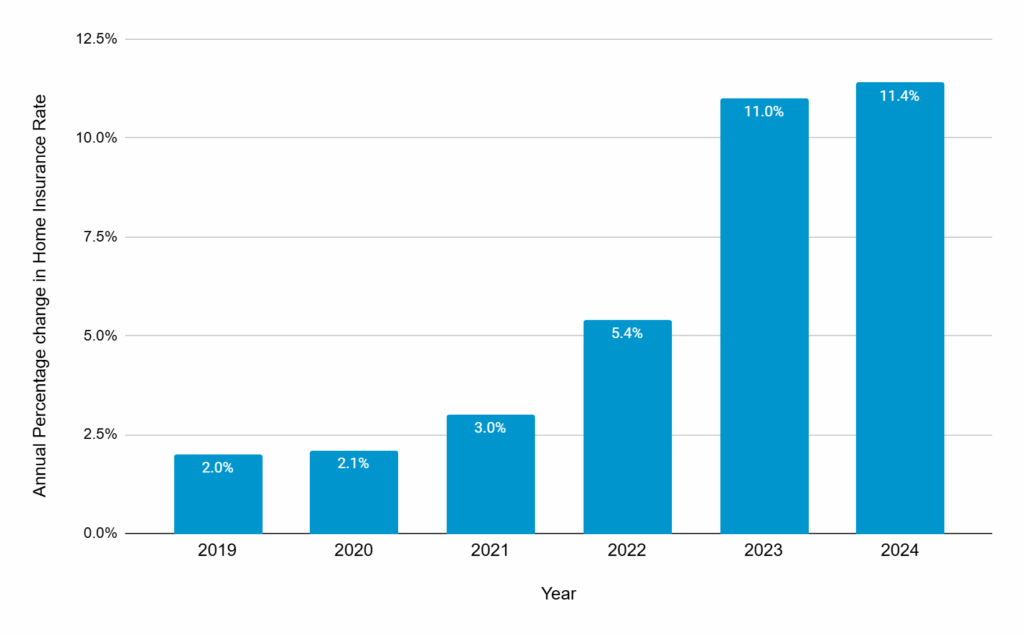

The cost of a standard homeowners policy, regardless of the property’s location and risk profile, is going up. US homeowners’ insurance rates jumped 40.4% from 2019 through 2024 to $2,801, according to a LendingTree analysis of data from S&P Global’s RateWatch.

Much of that increase has come in the last two years, which both saw increases of double-digit percentage points, while rates have increased for each year for the last six.

Annual % Change in Home Insurance Rate vs. Year

Source: S&P Global data

As mortgage providers require homeowners to get home insurance on the homes they underwrite, it is a necessary, and increasing, expense for most homebuyers and homeowners.

Climate-related risk is playing a role in these increases, particularly in regions with more significant weather events.

Homeowners in higher risk areas paid an average of $500 more in annual premiums than those in lower-risk areas in 2023, the National Bureau of Economic Research found in an analysis of over 47 million households’ property insurance expenditures from 2014 to 2023. In 2018, the discrepancy was $300.

While climate events and related home insurance costs are impacting more homeowners, and more buyers, Americans are not yet thinking of climate as a primary factor in a move. Change of climate and natural disaster registered as 0.9 and 0.3%, respectively, for reasons people gave for moving in 2022, according to the most recent U.S. Census Bureau data available. These came behind housing (41.6%), family (26.5%), employment (16.1%), and relationship change (4.4%).

This article focused on homeowners’ insurance, but property taxes and homeowners’ association fees are similarly impacted by the growing frequency of severe weather events.

Climate events have long been a concern for many, but it will become an increasingly foundational topic for more Americans as its impact increasingly hits something they cannot ignore: their wallet.

This article provides additional analysis and data related to the trend presented in the 2025 Swanepoel Trends Report, “Impact of Climate on the Future of U.S. Real Estate.” This discussion focuses specifically on residential real estate insurance changes in three markets to explore the impact of climate change on homeowners’ insurance availability and the costs facing homeowners and homebuyers.

Rising Costs, Increased Risk In Context

A decade ago, few insurance companies had strategies for addressing climate risk as a business issue, yet today many have begun to factor climate into their modeling. To accommodate the climate risk they see, insurers can raise rates, reduce coverage, increase premiums or add exclusions – but intensifying extreme weather events make it more difficult for these companies to see positive returns.

When insurers decide they cannot make it work, they leave the market, which leaves states’ last resort insurance plan to fill the gap.

To contextualize the reality of rising insurance costs, this section examines available data for Miami-Dade County in Florida, Harris County in Texas and Los Angeles County in California. Each of these counties have FEMA risk scores of above 99, which means they are in the top 1% nationally for overall risk from natural hazards; this is an exceptionally high score.

These three areas all have significant increases in insurance premiums and use of insurers of last resort, which provide less coverage than typical insurers, such as only covering dwelling and personal property versus family liability and medical expenses.

These trends leave more homeowners in these areas exposed to more risk and costs, which, in turn, impacts the longer-term real estate demand and accessibility of these areas.

These trends are increasingly impacting homebuyers. An August 2025 survey of 1,000 prospective and recent homebuyers by Realtor.com found that a third (33.7%) found that home insurance challenges have forced them to completely change the geographic area of their home search.

Note: this discussion addresses the standard multi-peril homeowners’ policy or a state-run last-resort option. Unless otherwise noted, this section does not examine the additional flood, wind or earthquake policies individual consumers might need for their properties. Further, average premiums vary widely across policyholders due to chosen coverages and different deductibles as well as individual risk factors.

Miami-Dade County, Florida

Homeowners insurance premiums are going up within the state of Florida, particularly the southern area of the state. It is getting harder to insure, and more costly to own, a home there, thanks to the increasing risk, and cost, associated with hurricanes and flooding.

This risk factors into Florida having the US’s highest average homeowners’ insurance premium, which has grown by 47% from 2019 to 2024 due to intensifying hurricane risks, in a First Street analysis. Specifically, three of the Sunshine State’s five large metropolitan areas faced the highest insurance premium increases over that period: Miami (322%), Jacksonville (226%), Tampa (213%).

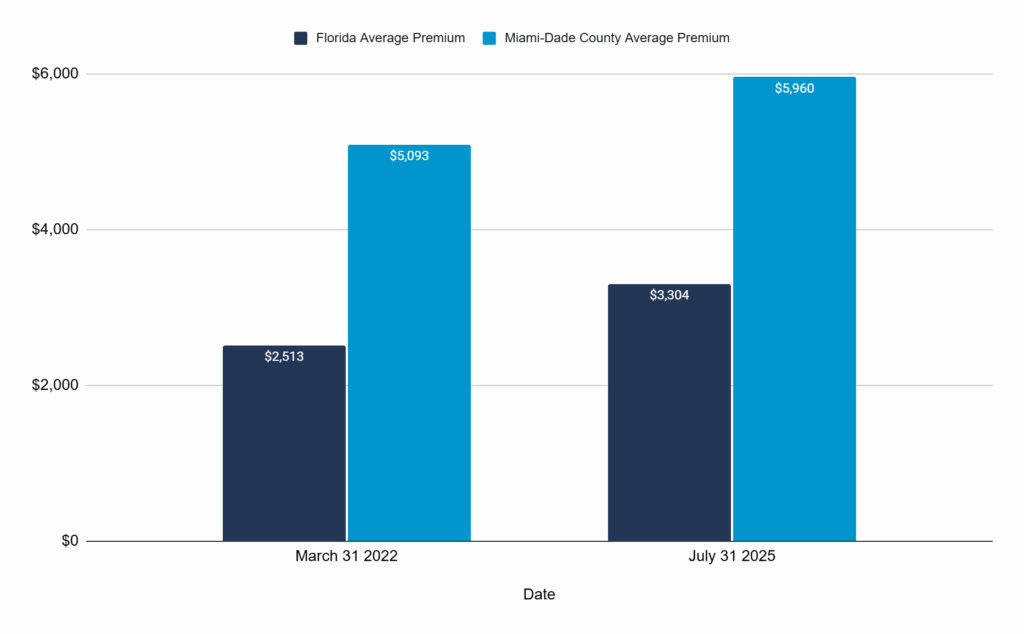

The average homeowners’ premium rates in Miami-Dade County (including wind), at nearly $6,000 per year, have been roughly double the state’s average in recent years. For context, the average premium rate for homeowners across the US was just under $2,801 in 2024, data from S&P Global’s RateWatch.

Average Homeowners Insurance Premium Rates Miami-Dade v. Florida

Source: Florida Office of Insurance Regulation

Insurance companies have been leaving the state due to climate and legal risk, which has made it more difficult for homeowners and homebuyers to get insurance. This has led to an increase of policies in force on the state’s last resort plan. These policies, as noted above, are less robust than private insurance policies, leaving homeowners with greater exposure to risk.

Miami-Dade County is one of only 18 counties with “very high” risk of negative impacts from natural hazard on FEMA’s Risk Index. The County’s 99.81 risk score (on a scale of 100) places it seventh nationwide, and fourth among major metropolitan areas for risk scores.

The high premium rates mean Miami-Dade County homeowners and homebuyers may risk going underinsured (or even uninsured) or be forced to work with the state’s backup insurance program, Citizens Property Insurance Company (Citizens).

At the end of the July 2025, the Citizens policies in force in Miami-Dade County reached an insured value of $30.3 billion, an increase of 42.6% over the $21.5 billion the firm insured at the end of July 2020. In the same period, the number of homeowners policies written in Miami-Dade County also climbed 40.8% from 87.548 to 123,265. This means more homeowners in the county have less robust homeowners’ insurance, leaving the homeowners more vulnerable to home-damaging climate events.

This has begun to impact migration. Looking only at population growth, Miami-Dade’s 64,211 influx was the second highest population growth among all US counties between 2023-2024, according to the US Census Bureau. However, when the inflow is compared to the outflow, as Redfin did in its April 2025 net domestic migration study, Miami was fifth among the Top 10 metro areas with a -16,781 drop in 2024.

Harris County, Texas (Houston)

Harris County suffered $160 billion in Hurricane Harvey damages in 2017, according to NOAA. This was immediately after two years of severe flooding brought $6.5 billion in damages.

These and other events have led to home insurance premium increases in the county. From 2015 to 2023, Harris County annual premiums increased by 43% to $3,325, according to an analysis by Kinder Institute at Rice University.

Rates in many of the county’s ZIP codes in and around its biggest city of Houston have increased closer to 60% in that period, the study showed.

Like in Florida and California, insurers struggling to maintain profits in the wake of significant climate events in counties such as Harris County, have begun pulling back from offering policies in Texas.

After Hurricane Beryl hit in 2024, Progressive announced widespread non-renewals and temporary restrictions on new homeowners’ business. Foremost Insurance, a holding of Farmers’ Insurance, had stopped writing and renewing policies two weeks before Beryl hit.

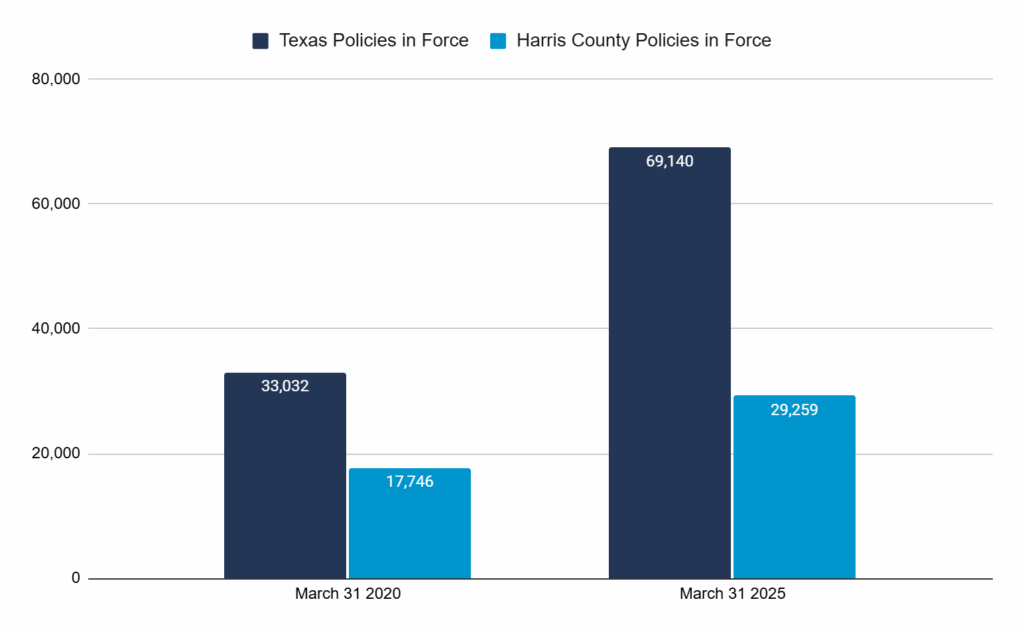

The state’s last-resort plan, the Texas FAIR Plan, which offers more basic coverage than standard plans, has seen the number of homeowners policies it provides statewide increase 109. 3% from 33,032 end of first quarter 2020 to 69,140 policies at end of first quarter 2025, according to the Texas FAIR Plan. Harris County accounted for nearly half (42.3%) of those policies as of March 31, 2025.

Texas and Harris County Homeowners’ Policies in Force

Source: Texas FAIR Plan Association

As with Miami-Dade County, homeowners insurance rate increases and limited availability to full-featured policies have not slowed migration to the county. From 2023-2024, Harris County saw the largest increase in population of any US county, according to the US Census Bureau, at 105,852.

Yet net domestic migration shows a different picture. Although Houston’s net domestic migration was 21,240 people in 2024, this was 46.2% below 2023’s 39,461, according to T3 Sixty analysis of Redfin data.

Fewer residents coming into Harris County could mean more buyer leverage. For homesellers, that could translate to longer listing times and needing to offer concessions (especially in more disaster-prone areas). Houston already has a below-average number of engage home shoppers per listings, according to Zillow. While the national average is about 5.5 people sharing or saving a listing in a market, Houston sees only 3.4 people engaged with its listings.

Los Angeles County, California

In the wake of the Palisades and Eaton fires, which erupted in Los Angeles County in January 2025 burned for 24 days over 37,000 acres, private insurers appealed to state regulators for $1 billion to help cover their losses.

The assessment, approved in February 2025, will be collected from private insurers doing business in the state and inevitably passed on to consumers in premium rate increases. Even when private insurance is available, high premium rates can limit budget flexibility, pricing some buyers out of the market.

The average annual homeowners’ insurance premium has been rising across the state, not just in Los Angeles County. The average annual premium in the state is expected to rise by approximately 21% in 2025 from the year before to nearly $3,000, according to an analysis from insurance shopping site Insurify.

In addition, as in Miami-Dade County, homeowners and homebuyers face difficulty getting home insurance due to the withdrawal from the California market of major private carriers.

For example, State Farm General, California’s largest insurance provider, stopped writing new policies in the state in 2023. In September 2024, the firm announced its intention to drop more than 1 million policies over the next five years.

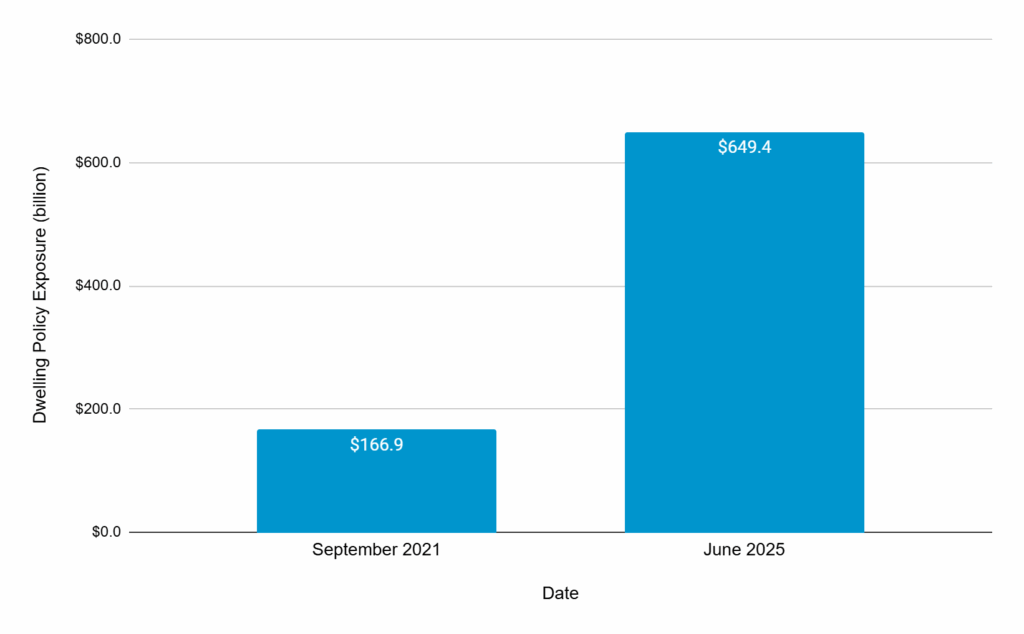

Statewide, over the past three years, enrollment in California’s last-resort insurance plan (the FAIR Plan), which provides more bare-bones coverage to homeowners, increased dramatically. From September 2021 to June 2025, the dwelling policy exposure jumped 289.1% to $649.4 billion.

FAIR Plan Policy Exposure (billion) vs. Date

Source: California FAIR Plan

First Street labels Los Angeles County – which has a 100 FEMA risk score (out of 100) – a “tipping point” community. This means First Street predicts the county will see its population decrease in response to insurance challenges over the next 30 years.

Rising homeowners’ insurance rates, fewer providers and less robust coverage in Los Angeles County, is a contributing factor in the net outmigration from the county and in residents’ increased exposure to risk. The county’s population of 9.8 million represents a decline that has occurred in recent years after reaching a peak of 10.1 million residents in 2016. Between 2023 and 2024, the county lost 136,384 residents.

Affordability no doubt plays a role in this drop, but the related costs due to climate risk and insurance costs also contribute. Los Angeles County may indicate a future for other high-risk areas.

Implications for industry professionals

The scenarios chronicled in the three counties above exemplify how climate events and area risk profiles increase fundamental monthly costs most homeowners pay. As the climate appears to be more volatile, this will unavoidably impact home prices, demand and migration patterns in coming years.

Potential homebuyers, facing difficulty getting private insurance, may decide to look elsewhere. As a result, homesellers – even those with intact homes – face a shrinking pool of buyers, which could see sellers having to offer concessions and prices below previous appraisals.

This most directly impacts first-time homebuyers, which most often have a mortgage (and therefore homeowners’ insurance) and are stretching to meet their monthly payments. However, homeowners at all income levels could face challenges insuring an existing or new purchase home and the pool of qualified, willing buyers is shrinking.

The nationwide epidemic of under- or uninsured homeowners can also affect long-term property values in a market. The Consumer Federation of America in 2023 analyzed housing survey data from the US Census Bureau and found:

- One in thirteen homeowners across the United States were uninsured (7.4 percent), equivalent to 6.1 million homeowners.

- Homeowners making under $50,000 a year were twice as likely as the general population to be uninsured (15 percent).

- Homes built before 2000 were almost twice as likely to be uninsured compared to homes built in the last two decades.

Rural areas saw 12% uninsured homeowners on average. Nevertheless, the highest shares of uninsured homeowners were seen in metro Miami (15%) and Houston (10%). Los Angeles had 5% uninsured compared to the 7% average for metro areas.

A lack of insurance is particularly problematic when a catastrophic natural event happens. The uninsured and underinsured may not be able to afford to rebuild. This can undermine property values in a market, which threatens the property taxes communities rely on to rebuild and encourage resilience. Meanwhile, substantial property tax increases can further erode consumer willingness to invest in homes of their own or drive homebuyers to migrate.

Addressing the Issue

Insurance rates and the affordability issue garner attention from different quarters. Fighting the battle against steep insurance hikes, state legislatures and insurance commissioners have passed laws and changed procedures to encourage price transparency and set price hike thresholds. Meanwhile, grassroot activists and consumer advocates have taken legal action for rates rollbacks and to provide evidence of the rate burden on consumers.

Politicians have also shown initiative on climate resilience adaptations. Alabama offers grants to homeowners to fortify their home against wind damage and mandates insurance companies provide discounts to homes meeting fortified standards. Louisiana implemented strict elevation requirements for new construction in flood zones after Hurricane Katrina. California’s building code requires fire-resistant materials and vegetation management in wildfire zones.

Brokers and agents can also play a role.

Brokerages and agents would be smart to deeply understand the home insurance costs and availability of their areas and where premiums are forecasted to go. Often, rates vary even by the ZIP code as insurance adjusters have more fine-tuned models.

More broadly, real estate professionals can provide a valuable service to consumers by:

- Alerting them to areas more susceptible to climate event impacts

- Encouraging buyers to weigh how climate risks might affect property values over time

- Drawing attention to proximity to essential services and emergency response facilities, which could prove more important than ever before

- Learning about market climate adaptation and infrastructure plans to communicate to buyers and sellers what changes may command premium prices

- Identifying climate resilience features of a home (or their absence)

- Helping buyers budget for any mitigation efforts they may need to take on

- Educating sellers about fortifications they could add to better prepare their homes for market

Brokers and agents should work to fully understand the operating costs for owning a home in the various neighborhoods they cover (not just comparable home prices, but also insurance and taxes). Learn also about insurance coverage availability and how living in different areas (less susceptible to climate events) may potentially lower costs for owning and operating the home.

Takeaway

Many Americans do not yet register climate as a significant risk and incorporate as a key factor in deciding where and why to move.

Yet the growing prevalence of significant climate events is increasing the costs and availability of homeowners insurance in more areas of the country, which, as they persist, will undoubtedly impact buyer demand and housing affordability to a greater degree.

Residential real estate brokers must educate themselves about the issue to be able to best counsel consumers about insurance options, share possible discounts achievable from risk mitigation efforts and inform their clients about the reality of homeownership in an area at high-risk of climate-related disasters.