Thanks to the all-time lows that mortgage rates reached just a few years ago, most homeowners have mortgage rates at or below existing rates. This means that most homeowners face higher rates if they purchase a new home. This keeps them locked in to their current home.

The mortgage lock-in effect is one of the key factors dampening home sales in the U.S.

In the first quarter of 2023, nearly two-thirds (61.0 percent) of outstanding mortgage loans carried an interest rate of less than 4 percent, according to FHFA data. Nearly a quarter (23.3 percent), carried below 3 percent. Most homeowners with a mortgage (90.7 percent) have a rate below 6 percent.

This article explores how the lock-in effect varies by geography.

Geographic Differences

The mortgage lock-in effect varies geographically for the simple reason that more recent mortgage loans exist in areas with stronger home sales. And when mortgage rates are low, as they were in 2020 and 2021, areas of the country with the most home sales will capture a larger share of lower-rate mortgages.

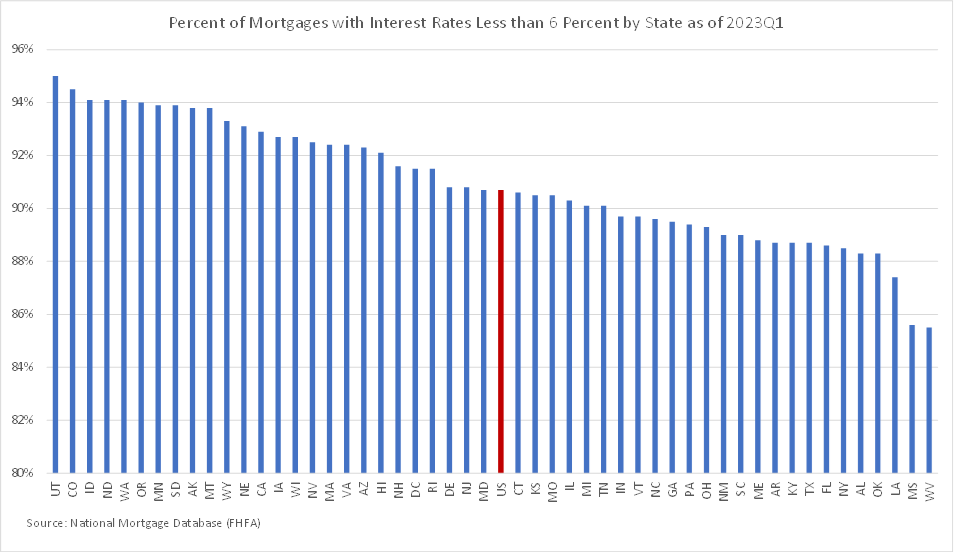

As the chart below illustrates, more than 95 percent of Utah borrowers have mortgages with a rate of less than 6 percent, according to U.S. Federal Housing Finance Agency data.

In fact, 25 states are above the national average of 90.7 percent. At the other end of the spectrum, Mississippi and West Virginia had the lowest percent of mortgage borrowers with sub-6 percent mortgage rates, but even in these states the percentage is greater than 85 percent.

One explanation for the variation is that many of the states with the highest percentage of sub-6 percent mortgages are home to metro areas that have experienced a rapid pace of home sales, especially in the past few years.

Seven of the top 10 states are in the West, reflecting the long-standing pattern of strong in-migration to the Pacific Northwest and Mountain states. More recently, the pandemic-era work-from-anywhere shift made places like Salt Lake City, Boise, Denver, Bend (OR) and Phoenix particularly attractive to movers.

In fact, more than 70 percent of mortgages in both Utah and Colorado were originated during the four-year period through the first quarter of 2023 when mortgage rates reached a low of less than 3 percent, fully 10 percentage points higher than the comparable nationwide share of 60 percent.

Takeaway

Understanding the nuance of how mortgages impact home sales can help brokerages refine their strategies based on where they operate. Brokerages use targeted geographic mortgage information to adapt their business strategies and messaging to unlock more inventory and capture more sellers.