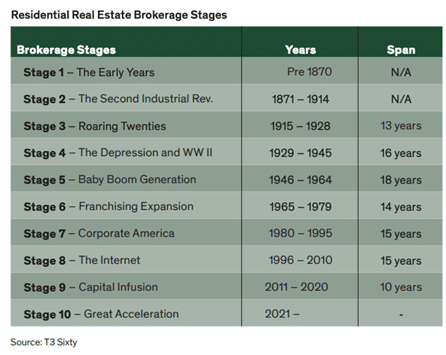

To put the ever-evolving real estate industry into perspective, T3 Sixty has identified a framework for the major innovations and developments as they have occurred over time in what it terms real estate brokerage stages.

First introduced in the 2019 Swanepoel Trends Report, the T3 Brokerage Stages concept helps real estate leaders understand where the industry has been and where it’s going.

This article provides an outline for the framework.

Brokerage Industry Stages

Economic, financial, and political cycles aside, the residential real estate brokerage industry itself evolves by innovation stages. Over the last century, the industry experienced ten stages illustrated in the chart below.

Each stage creates new players who innovate more frequently and differently than incumbents. They use innovative new technologies to create their opportunities. This exposes the vulnerability of existing players with large market share and creates uncertainty. Although not every new player succeeds, collectively, innovators shift the landscape. Incumbents who dig their heels in and resist evolving, face becoming dated and less relevant.

Today’s industry emerged from advances and developments in the stages that came before it.

During Stage 6 (Franchising Expansion), Century 21 exploded onto the scene and became the largest residential real estate company in the world by using the concept of franchising, which no company had used before in residential real estate brokerage.

In Stage 7 (Corporate America), HFS, the precursor to Anywhere Real Estate, emerged and acquired more franchise brands than ever before, while many at the time thought one company could not own competing franchise brands. With that move, Anywhere became the industry’s largest real estate brokerage and franchise enterprise.

During Stage 8 (The Internet), first Homestore and later Zillow created a portal and moved homebuyers to the web. Zillow innovated and created a dominant consumer brand and became a company with a $25 billion market cap in approximately a decade.

In Stage 9 (Capital Infusion), many new business models emerged and expanded with funding while incumbents claimed they offered nothing new or lasting. Companies such as Redfin, Compass and eXp Realty saw explosive growth, and grew to among the nation’s five largest brokerages.

As a result of the pandemic, innovation and consumer habits within Stage 9 accelerated, which reduced its anticipated duration from the 15-year average down to approximately 10 years. This basically means that five years of expected growth was crammed into one or two years.

The arrival of Stage 10 (Great Acceleration) represents a culmination of the billions of dollars of financing that investors, Wall Street, public markets, and companies pumped into the residential real estate brokerage industry over the last decade transformed the brokerage industry from one dominated by regional players with fragmented and standard technology to increasingly publicly traded players with sophisticated tech platforms and huge amounts of capital.

In this stage, the industry’s largest players are accelerating their growth and dominance to become mega real estate enterprises at sizes not seen before as they work to develop extensive one-stop real estate services that extend far beyond the transaction. At the end of this stage, umbrella enterprises will dominate the industry on many different levels – brokerage, technology, mortgage, and so on.

Takeaway

To compete in Stage 10 requires leaders with the ability, courage and aptitude to adapt. The way forward requires clarity and smart decisions, and an open mind. The answer for many brokerages might involve doing more transactions at lower commissions, refining a focus toward higher-priced properties in specific neighborhoods and communities, narrowing a focus on systems and technology that match a specific operating model. Regardless, the next stage’s biggest companies may be small now, but are pioneering new advantages – one of the reasons T3 Sixty does deep industry analysis, as its leaders should, too.