As mortgage rates rise, inventory stagnates and the economy remains unpredictable, luxury real estate, which typically offers higher margins and less volatility than the lower-priced market, has become increasingly attractive to brokerages and agents.

There are many definitions of luxury real estate. A working definition for this article can be homes from 1.5 to 2X an area’s median home price and above. At a line roughly about 3X an area’s median home price, the market gets even more rarified, into another category altogether.

Based on past patterns, the luxury market remains relatively insulated from broader macroeconomic conditions, such as interest rate increases and even low inventory. Those with the means can bypass interest rates by purchasing homes with all cash and present very competitive offers for the homes that do come on the market.

This article provides some insight into the current state of the luxury market and its potential future trajectory.

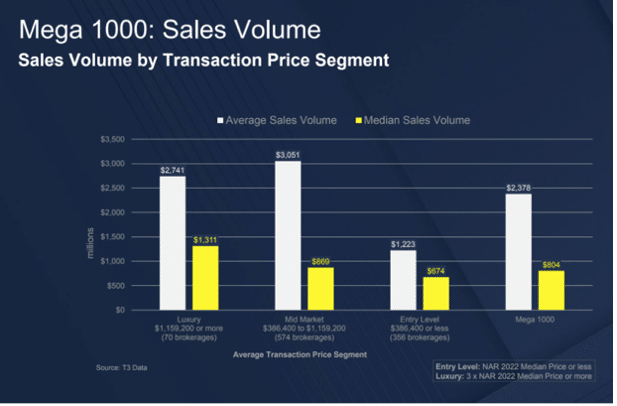

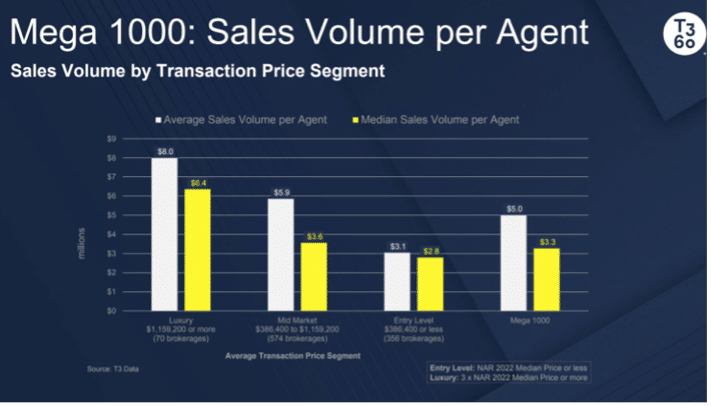

Looking at luxury Illustrated in the table below, the 2023 Mega 1000 analysis calculates that the median sales volume per agent across luxury real estate surpasses that of numerous other markets, indicating twice the number of entry-level brokerages.

Although luxury sales accounted for only 8.1% of the total sales volume for the 2023 Mega 1000, the median sales figures for brokerages and agents demonstrate the potential for substantial profits in this segment. This suggests that brokers and agents specializing in luxury properties can generate higher revenue per transaction.

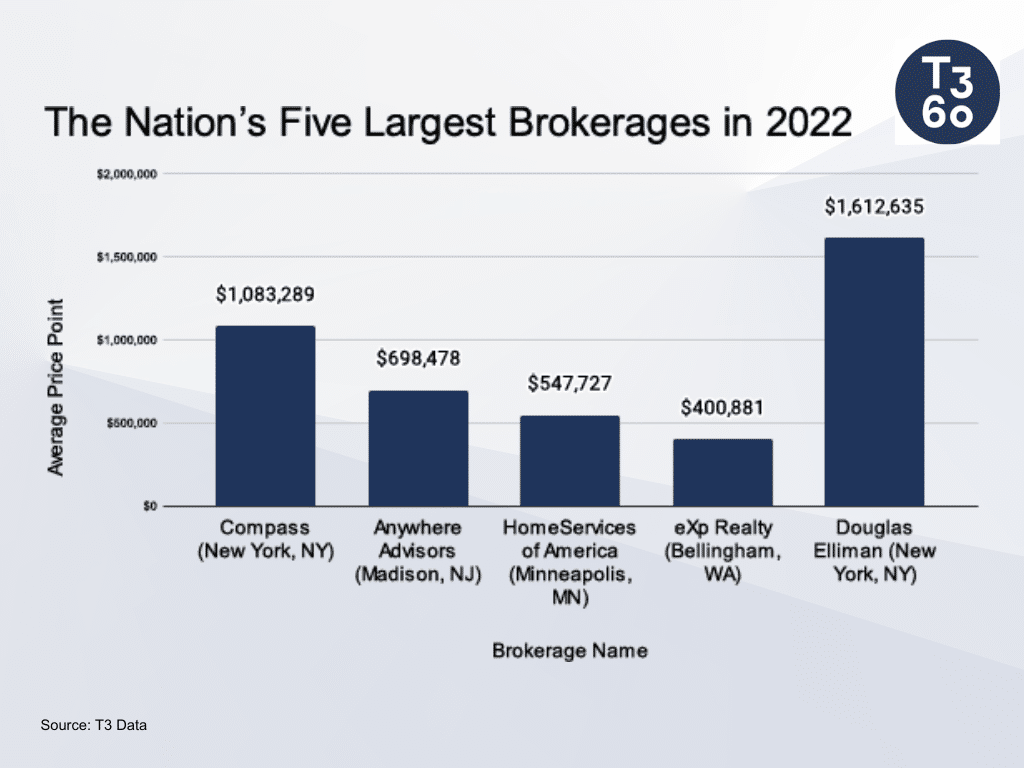

Many brokerage companies have luxury divisions and more are adding them. EXp Realty, Redfin and Keller Williams Realty, among the nation’s largest firms, for example, each introduced luxury divisions in the last year. The nation’s five largest brokerages in 2022, all had average price points of homes they helped sell that year above the national median home price of $386,400.

Luxury brokers and agents should leverage the average price point as one of many factors in their market analysis. It can serve as a guide for positioning, pricing, and understanding the broader market landscape, helping them better serve their luxury clientele.

The global effect

Luxury real estate has witnessed a surge in international buyers and investors seeking exclusive properties worldwide.

Top European tax havens are in high demand offering refuge from income taxes, capital-gains taxes, and corporate taxes. For example, Switzerland, known as a safe haven, has low-income tax rates and tax-deductible mortgage loans that have been attracting luxury buyers since the pandemic. The Caribbean and Latin American regions are experiencing substantial growth in the luxury market as well. The Bahamas surpassed $1 billion in sales by the end of the first three quarters of 2022.

However, according to the National Association of Realtors, the number of foreign buyers seeking homes in the U.S. noticeably declined in 2022.

Takeaway

The luxury real estate market has become an attractive focus for many brokerages, offering higher margins and stability amid rising mortgage rates, stagnant inventory, and economic uncertainty. More brokerages are focusing on the segment as transaction counts drop.